Useful Life Of Furniture And Fixtures As Per Companies Act 2013 . the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. Depreciation is the systematic allocation of the depreciable amount of an. 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used. However, where cost of part. Useful life prescribed under schedule ii is for whole of the asset. 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. subject to parts a and b above, the following are the useful lives of various tangible assets: 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value. useful lives to compute depreciation.

from www.chegg.com

the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. subject to parts a and b above, the following are the useful lives of various tangible assets: Useful life prescribed under schedule ii is for whole of the asset. Depreciation is the systematic allocation of the depreciable amount of an. However, where cost of part. 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. useful lives to compute depreciation. 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value. 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used.

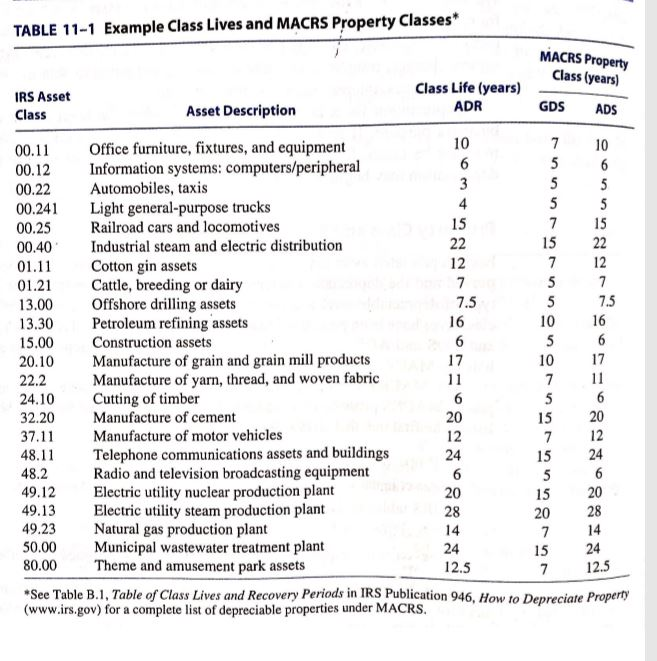

TABLE 111 Example Class Lives and MACRS Property

Useful Life Of Furniture And Fixtures As Per Companies Act 2013 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value. 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used. useful lives to compute depreciation. 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. Useful life prescribed under schedule ii is for whole of the asset. However, where cost of part. the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. subject to parts a and b above, the following are the useful lives of various tangible assets: Depreciation is the systematic allocation of the depreciable amount of an. 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value.

From marketbusinessnews.com

What is furniture, fixtures and equipment (FF&E)? Definition and examples Useful Life Of Furniture And Fixtures As Per Companies Act 2013 subject to parts a and b above, the following are the useful lives of various tangible assets: Useful life prescribed under schedule ii is for whole of the asset. However, where cost of part. 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value. 103 rows. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From slidecourse.blogspot.com

Useful Life Of Furniture For Depreciation Slide Course Useful Life Of Furniture And Fixtures As Per Companies Act 2013 Depreciation is the systematic allocation of the depreciable amount of an. useful lives to compute depreciation. subject to parts a and b above, the following are the useful lives of various tangible assets: 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Useful Life Of Furniture And Fixtures As Per Companies Act 2013 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used. 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. Useful life prescribed under schedule ii is for. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.youtube.com

UseFul Life Of Assets As Per Companies Act 2013 Useful Life Of Assets Useful Life Of Furniture And Fixtures As Per Companies Act 2013 Depreciation is the systematic allocation of the depreciable amount of an. useful lives to compute depreciation. the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. subject to parts a and b above, the following are the useful lives of various tangible. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From khatabook.com

Depreciation Rate as Per Companies Act How to Use Depreciation Calculator Useful Life Of Furniture And Fixtures As Per Companies Act 2013 Depreciation is the systematic allocation of the depreciable amount of an. 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.boe.ca.gov

Valuation of Personal Property and Fixtures Useful Life Of Furniture And Fixtures As Per Companies Act 2013 the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used. subject to parts a and b above, the following. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.academia.edu

(PDF) RATES OF DEPRECIATION AS PER COMPANIES ACT, 1956 SCHEDULE XIV Useful Life Of Furniture And Fixtures As Per Companies Act 2013 useful lives to compute depreciation. Useful life prescribed under schedule ii is for whole of the asset. the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. 103 rows as per schedule ii, useful life is either (i) the period over which. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Useful Life Of Furniture And Fixtures As Per Companies Act 2013 useful lives to compute depreciation. However, where cost of part. Depreciation is the systematic allocation of the depreciable amount of an. 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. 129 rows depreciation as per new companies act is. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.chegg.com

Solved Estimating Useful Life and Percent Used Up The Useful Life Of Furniture And Fixtures As Per Companies Act 2013 Useful life prescribed under schedule ii is for whole of the asset. 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value. However, where cost of part. 126 rows the useful life of an asset is the period over which an asset is expected to be available. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Useful Life Of Furniture And Fixtures As Per Companies Act 2013 subject to parts a and b above, the following are the useful lives of various tangible assets: 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value. 126 rows the useful life of an asset is the period over which an asset is expected to be. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.chegg.com

Solved a. Sold at a gain of 7,000 furniture and fixtures Useful Life Of Furniture And Fixtures As Per Companies Act 2013 Depreciation is the systematic allocation of the depreciable amount of an. 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used. Useful life prescribed under schedule ii is for whole of the asset. 126 rows the useful life of an asset is the period over. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.vrogue.co

Depreciation Rate As Per Companies Act How To Use Dep vrogue.co Useful Life Of Furniture And Fixtures As Per Companies Act 2013 subject to parts a and b above, the following are the useful lives of various tangible assets: the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. Useful life prescribed under schedule ii is for whole of the asset. useful lives to. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.coursehero.com

[Solved] . LO5, 6 1642. Estimating Useful Life, Percent Used Up, and Useful Life Of Furniture And Fixtures As Per Companies Act 2013 Depreciation is the systematic allocation of the depreciable amount of an. subject to parts a and b above, the following are the useful lives of various tangible assets: useful lives to compute depreciation. Useful life prescribed under schedule ii is for whole of the asset. However, where cost of part. 129 rows depreciation as per new companies. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.chegg.com

Solved AJ Manufacturing Company incurred 56,500 of fixed Useful Life Of Furniture And Fixtures As Per Companies Act 2013 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used. subject to parts a and b above, the following are the useful lives of various tangible assets: the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From mungfali.com

Depreciation Rate Useful Life Of Furniture And Fixtures As Per Companies Act 2013 subject to parts a and b above, the following are the useful lives of various tangible assets: 103 rows as per schedule ii, useful life is either (i) the period over which a depreciable asset is expected to be used. useful lives to compute depreciation. However, where cost of part. 126 rows the useful life of. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.congress-intercultural.eu

Calculate Depreciation As Per Companies Act, 2013, 51 OFF Useful Life Of Furniture And Fixtures As Per Companies Act 2013 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. useful lives to compute depreciation. Useful life prescribed under schedule ii is for whole of the asset. However, where cost of part. 103 rows as per schedule ii, useful life. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.allinfohome.com

67 Aweinspiring living room furniture layout rotation Voted By The Useful Life Of Furniture And Fixtures As Per Companies Act 2013 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. 129 rows depreciation as per new companies act is allowed on the basis of useful life of assets and residual value. Depreciation is the systematic allocation of the depreciable amount of. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.

From www.chegg.com

TABLE 111 Example Class Lives and MACRS Property Useful Life Of Furniture And Fixtures As Per Companies Act 2013 the companies act, 2013 replaces schedule xiv by schedule ii which requires systematic allocation of the depreciable amount of an asset over its useful life. 126 rows the useful life of an asset is the period over which an asset is expected to be available for use by an entity, or the. Depreciation is the systematic allocation of. Useful Life Of Furniture And Fixtures As Per Companies Act 2013.